Given the rapid evolution of mobile technology and its impact on banking, the focus on mobile banking, payment and commerce strategy is an urgent requirement for all banks in order to survive.

Mobile eCommerce and payments has seen unprecedented growth in the recent years. Several analysts have estimated that in the next few years, the mobile payments industry will be worth $1 trillion.

As a matter of fact, world’s major banks have prioritized mobile payments, mobile banking and online banking as their top need, among other IT initiatives.

Consumers are increasingly using their smart phones to buy and make payments, as it is easy, convenient, speedy and gives them better access to deals and offers.

At the same time, mobile payment is beneficial for business as increases sales, loyal returning customer base, analyzing and tracking customer behavior, reduced cost. It is a win-win situation for both consumers and offering banks and ecommerce companies.

Need

As mobile internet use has grown sporadically and is expected to further grow exponentially both in value and volume globally, banking and payments on the go is taking over other channels.

Banks need to provide a platform for mobile payments to protect their retail payments businesses from digital disruption, which is likely, due to rise of share in mobile payment transaction of non-banks.

Filling out unnecessary forms and credit-card information, to make payments on smart phones, most of which have small physical or virtual keyboards, can be time consuming and challenging.

This gives rise to increased use of mobile wallets, mobile eCommerce and mobile payments.

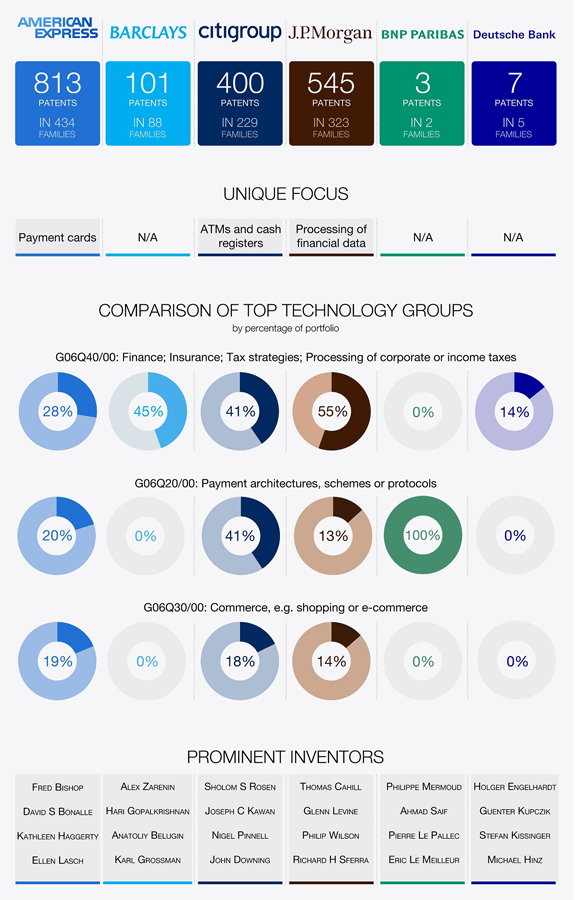

It is still an infant business where only some initiatives have succeeded in attracting a significant user base. Adoption of mobile payments is slower in developed nations than in developing like India, Korea and parts of Africa.

Therefore some banks are still in dilemma about jumping on the mobile bandwagon yet.

Challenge and Solutions

1. Competition from non-banks, pushing innovation and complex partnerships

There are many new entrants investing majorly in mobile payments: wireless carriers, AT&T, Verizon Wireless, and T-Mobile, e-commerce companies like Google with Google Wallet, merchants like Walmart and Target, payment service providers like PayPal, as well as money transfer operators, credit card companies and new start-ups emerging almost every day.

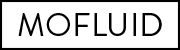

According to Forbes, banks are going to lose the battle against mobile and ecommerce leaders, as banks need to compete against some serious patent hungry challengers.

These new entrants in the mobile landscape are not only challenging the existing rules but are paving the way for new innovation.

Their rise is creating a blurred line between mobile, marketing, banks, ecommerce and service providers.

It means that banks not only need innovation and fast growth but also need to collaborate with them to create a partnership model, horizontal (multi-operator) and vertical (multi-industry), that will sustain the technology and expertise requirements and global approach.

The changing mobile landscape of complex partnership models brings the focus back to customer, enriching its experience and improving business rather than competing with each other.

2. Need for Interoperability in the Complex Global Ecosystem

Innovation in mobile payment is largely isolated around the world, based on the local-region-specific requirements. The mobile revolution began way back in 2000 in Philippines with the introduction of Smart Money – world’s first cash card lined to a mobile.

With innovation gaining momentum across developing nations, the developed nations soon realized the growth of mobile wallets, easy availability of NFC enabled phones and apps like Paypal.

But the mobile payment services demand and growth in developed and developing market is different, reflecting how lack of formal financial institution is accelerating growth in developing countries to make use of mobile payments to bridge the gap between the banked and unbanked.

According the Ernst & Young, “while demographics and socioeconomic forces clearly influence mobile money take-up, the regulatory environment often plays a “make-or-break” role. In developed markets, however, the challenges around regulatory oversight and policy agendas tend to be greater.

In many countries, mobile payments regulation remains highly fragmented, and addressing this requires sector-specific policies and consumer protection frameworks to be aligned.

However, the applicable regulations are often still fluid in developed markets, and regulators there are focused on increasing competition and efficiency in the financial services sector, as opposed to increasing financial inclusion in a way that prioritizes mobile payments per se.”

This presents the most critical challenge as the legal frameworks are not yet synchronized globally and payment ecosystems differ. The risk of legal oversight and policy agenda is more in developed nations.

The mobile landscape is in a big dilemma as the technologies are fragmented and there are too many company offering services making it a competitive market.

The visionary solution to this complex ecosystem is to bring interoperability between different mobile payment platforms and create a standardized way of making payment.

Interoperability benefits are quite clear as it not only increases your customer reach and easier implementation but also reduce cost, scalability and enhances customer experience.

3. Segment-based Strategy

Ecommerce leader Amazon led the way, by not only offering a wide array of product choices to its consumers but also personalizing the content based on the consumer information and purchase behavior.

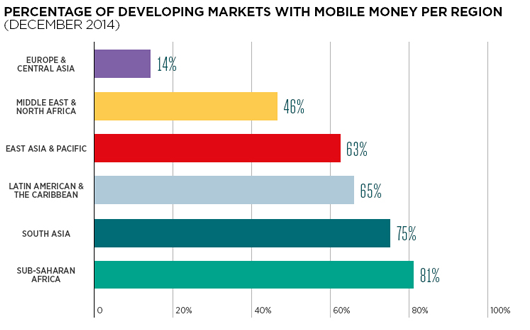

In order to increase the adoption of mobile banking services, the banks need to move away from “one-size-fits-all” approach.

Banks need to understand their customers, in order to understand the current market trends and predict the future trends.

In order to optimize customer retention and conversion, a bank needs to segment its customers based on various factors like demographic, age, sex, ethnicity and income groups. This will also help take the focus away from channels that have lower Return of Investment and invest strategically.

Winning strategies often focus on a particular segment of customers and create an appealing approach to that segment and cater to their preferred choice of product and services.

Different segments offer different opportunities and challenges. Once identified, realistic and targeted efforts can help banks become more efficient faster.

4. Integrate data with loyalty and reward-oriented scheme

Mobile payments will touch new heights with one-to-one relation with consumer by better understanding their requirement, preferences and tailor services based on that information.

Integrating with loyalty and reward oriented schemes along with better contextual relevance will play a pivotal role in increasing the reach of mobile payments and commerce.

Rewards are the biggest reason we prefer Credit card over other methods of payment. As the rewards in the form of points, gift cards and flyer miles are increasing, so is our loyalty towards a particular credit card. If such benefits are available through mobile transactions as well, the advantage for mobile companies will be bigger than we can imagine.

5. Privacy and Security

As more and more banks, ecommerce and mobile leaders are offering mobile banking, commerce and payment facilities, the risk of compromising sensitive data is increasing.

The biggest concern for a person in adopting mobile banking is security, according to a recent survey. If an individual is more confident about the privacy and security of his/ her personal financial information and money, it can drastically improve the mobile payment adoption.

New systems pose new security threat. Compromised data not only leads to serious implications but also tarnishes the company’s image forever.

This is an area that needs a lot of technical expertise and presents an opportunity for the banks to join hands with ecommerce companies. They will not only be using the established expertise but also gain easy customer insight that is critical for segmenting and targeting the users later.

If you plan to do it yourself, make your security architecture well aware of the trending security threats and vulnerabilities and promptly update system to safeguard against possible security breaches and use firewalls and monitoring system to avoid hackers.

We would rather recommend leveraging proven leaders in security to easily gain customer confidence and conversion.